Driven by the truck trade-in policy, October 2025 sales, while not reaching September's levels, still achieved a significant year-on-year increase, closing at 95,000 units, a substantial 43% increase year-on-year.

How did the sales and market share of several major heavy-duty truck manufacturers change in this crucial "Silver October" month? Let's take a look!

October saw the seventh consecutive month of growth for heavy-duty trucks, with electric heavy-duty trucks more than doubling in sales.

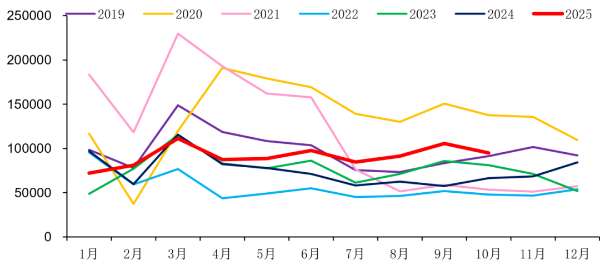

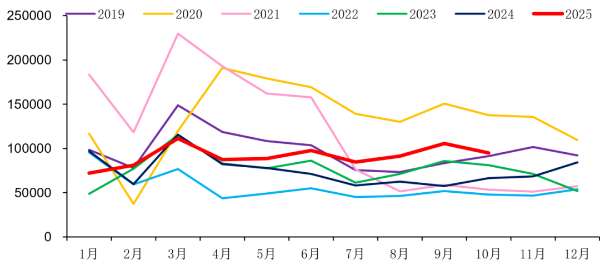

In October 2025, my country's heavy-duty truck market sold approximately 95,000 units (wholesale figures, including exports and new energy vehicles), a decrease of about 10% month-on-month, but an increase of about 43% compared to 66,400 units in the same period last year. This sales level is the second highest in the past eight years, only lower than the 137,500 units sold in October 2020.

To date, the heavy-duty truck market has achieved seven consecutive months of growth—sales in April and May increased by 6.5% and 13.6% year-on-year, respectively; June and July saw increases of 37% and 46%; August saw a 47% year-on-year increase; and September and October saw increases of 83% and 43% respectively, with an average growth rate of 39% over the past seven months. Cumulatively, from January to October this year, my country's heavy-duty truck market saw sales reach 918,000 units, a year-on-year increase of approximately 22%. It is expected that cumulative sales will reach one million units after November.

In October, domestic terminal sales (based on compulsory traffic insurance) continued to show rapid year-on-year growth, with a growth rate of approximately 61%, but a month-on-month decrease of nearly 14% (mainly due to the impact of the eight-day National Day holiday). Among them, new energy heavy-duty trucks continued to surge; natural gas heavy-duty trucks saw their third consecutive month of growth, achieving another doubling. It is precisely because of the support from domestic terminal demand and sales that the year-on-year growth rate of wholesale sales in my country's heavy-duty truck industry has shown a significant acceleration.

October sales of new energy heavy-duty trucks are estimated at around 20,000 units, representing a year-on-year increase of over 1.4 times, with a monthly industry penetration rate approaching 28%. With the trade-in policy nearing its end and the anticipated pre-emptive effect of the new energy vehicle purchase tax reduction being halved from January 1st next year, sales of new energy heavy-duty trucks in the last two months of the fourth quarter are expected to reach new highs. In addition, domestic diesel heavy-duty truck sales in October are expected to increase by nearly 20% year-on-year. Looking at overseas exports, China's heavy-duty truck export wholesale sales are expected to increase by over 10% year-on-year in October, making it certain that annual heavy-duty truck exports will exceed 300,000 units.

Sinotruk/Jiefang Exceed 20,000 Units, Dongfeng Increases by 60%, Foton Soars 1.5 Times

In the October sales rankings, Sinotruk continued to hold the top spot with 25,000 units sold, a year-on-year increase of 50%; Jiefang exceeded 20,000 units, a year-on-year increase of nearly 40%; Dongfeng's sales increased by 60% year-on-year; and Foton saw the highest growth rate, increasing by approximately 1.5 times year-on-year. Companies that outperformed the market in year-on-year growth include Foton, Dongfeng, Sinotruk, and XCMG. Cumulatively, companies achieving year-on-year market share growth from January to October this year mainly include Dongfeng, Foton, and XCMG.

Specifically, Sinotruk sold approximately 25,000 heavy-duty trucks in October, a year-on-year increase of approximately 51%, maintaining its leading position in the industry; its cumulative sales from January to October exceeded 250,000 units, a year-on-year increase of approximately 22%, with a market share of approximately 27.2%.

FAW Jiefang sold nearly 21,000 heavy-duty trucks in October, a year-on-year increase of approximately 36%; from January to October 2025, Jiefang's cumulative heavy-duty truck sales are projected to reach approximately 173,000 units, a year-on-year increase of approximately 14%, with a market share of approximately 18.8%, maintaining its second-place position in the industry.

Dongfeng Motor Corporation (including Dongfeng Commercial Vehicle and Dongfeng Liuzhou Chenglong) sold nearly 14,000 heavy-duty trucks in October, a year-on-year increase of approximately 60%. From January to October this year, Dongfeng Motor Corporation's cumulative sales of various types of heavy-duty trucks reached approximately 145,000 units, a year-on-year increase of approximately 23%, with a market share of approximately 15.8%, a year-on-year increase of 0.1 percentage points.

Beiqi Foton Motor sold nearly 14,000 heavy-duty trucks in October, a year-on-year increase of approximately 147%, which is the highest year-on-year growth rate among major companies that month. From January to October 2025, Beiqi Foton Motor's cumulative sales of various types of heavy-duty trucks reached nearly 118,000 units, a year-on-year increase of approximately 100%, with a market share of approximately 12.8%, a year-on-year increase of approximately 5 percentage points.

Shaanxi Automobile Group (including Shaanxi Heavy Truck and Shaanxi Commercial Vehicle) sold approximately 13,000 heavy trucks in October, representing a year-on-year increase of about 20%. From January to October 2025, Shaanxi Automobile Group sold approximately 147,000 heavy trucks of various types, a year-on-year increase of about 18%, with a market share of approximately 16%, maintaining its position among the top three in the industry in terms of cumulative sales.

The strong performance of the heavy truck market in 2025 is primarily driven by policy. From April to the fourth quarter of this year, the continuous growth of the heavy truck market benefited greatly from the promotion of the trade-in policy for commercial trucks. However, since August, more and more cities have suspended their trade-in subsidies due to local fiscal constraints; some regions, while retaining subsidy amounts, have adopted methods such as lotteries and pre-applications to control the total amount.

Fortunately, with the last batch of fiscal subsidies being distributed at the end of September, some regions have restarted subsidies. Coupled with the "tail-end effect" of the policy's end at the end of the year, the heavy truck market in November has the conditions for high year-on-year growth.