After a surge in sales at the end of 2025, 2026 officially began. Amidst the coexistence of "volume surges" and "overspending," the market's most pressing questions have emerged: How will the market perform at the start of the year? Can post-holiday demand quickly pick up? Does the engineering-related segment possess a first-mover advantage? Looking at the overall performance in January, the answers are gradually becoming clearer.

January Heavy Truck Market: Strong Wholesale, Weak Retail

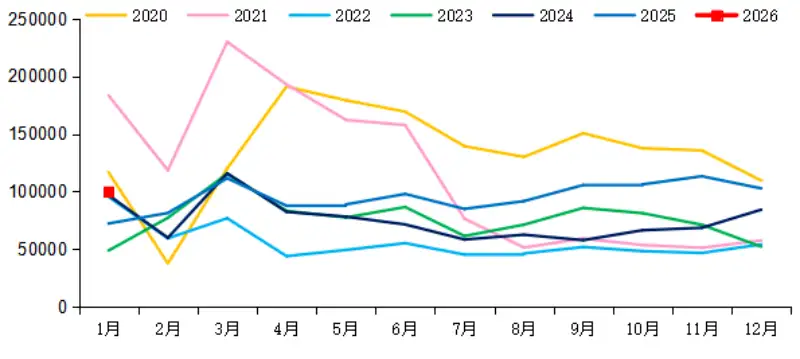

According to preliminary data from First Commercial Vehicle Network, in January, my country's heavy truck market sold approximately 100,000 units (wholesale figures, including exports and new energy vehicles), roughly flat compared to December 2025, but a significant increase of approximately 39% compared to the 72,200 units sold in the same period last year.

In January 2026, the heavy truck market exhibited a trend of "strong wholesale, weak retail." On the one hand, the emphasis placed on a strong start by OEMs and distribution channels kept wholesale at a high level; on the other hand, the approaching Spring Festival, financial arrangements, and the early release of pent-up demand from the end of last year significantly slowed down the pace of vehicle purchases by end users. This structural divergence is not unexpected. Every year at the beginning of the first quarter, especially in years following the Spring Festival, there is a brief "vacuum period" in end-user demand, as the market is primarily building momentum for a post-holiday recovery.

New Energy and Exports: New Energy Vehicles Experience a Short-Term Decline; Exports Remain a "Stabilizer"

New Energy Heavy Trucks

Driven by the combined effects of the old-for-new commercial truck trade-in policy at the end of last year and the halving of the purchase tax on new energy vehicles starting January 1, 2026, demand for new energy heavy trucks was significantly released ahead of schedule. End-user sales of new energy heavy trucks in the last month of 2025 "exploded," with monthly sales and penetration rates both breaking historical records.

Entering the beginning of 2026, the market naturally entered a digestion phase, and the overall penetration rate of new energy vehicles saw a correction. However, looking at the sub-segments, not all new energy vehicle models weakened simultaneously.

Engineering-type new energy vehicles, such as new energy mixer trucks, demonstrated better resilience to market fluctuations. The reasons are as follows: engineering projects are more "plan-driven," less affected by short-term sentiment; concrete mixer trucks operate primarily on fixed routes and at high frequencies, making it easier to showcase the cost and efficiency advantages of new energy vehicles; some engineering projects adopt "segmented construction" around the Spring Festival, creating a rigid demand for additional transport capacity. This also makes engineering-type new energy vehicles one of the few subcategories of new energy heavy trucks with "relatively stable demand."

Heavy Truck Exports

In overseas markets, in January 2026, my country's heavy truck exports continued to maintain steady growth, increasing by more than 20% year-on-year, with overall demand for engineering equipment remaining stable. Compared to long-distance transport vehicles, engineering vehicles are closer to overseas infrastructure and resource development needs, with relatively continuous order cycles, providing sustained space for specialized models such as concrete mixer trucks.

First Quarter Trends: Heavy Truck Market

The first quarter focuses on market rhythm, the second quarter on policy. Overall, the core keyword for the heavy truck market in the first quarter of 2026 remains "digestion and transition": on the one hand, digesting the concentrated demand released at the end of last year, and on the other hand, waiting for the gradual recovery of the terminal market after the Spring Festival, reserving space for the implementation of subsequent policies. The real "highlights" and growth are more likely to be concentrated in the second quarter. On the one hand, the Spring Festival falls later this year (Lunar New Year's Eve is February 16th), shifting the peak season for heavy-duty truck sales accordingly. On the other hand, detailed policies regarding the replacement of National III and National IV emission standard commercial trucks are expected to be clarified and implemented across various regions in the latter part of the first quarter, potentially generating substantial demand in the heavy-duty truck market in the second quarter. The next step for the heavy-duty truck market is worth waiting patiently for!