Driven by the continued trade-in policy for older trucks, the heavy-duty truck industry achieved a remarkable sales volume of 105,000 units in September 2025, a year-on-year increase of over 80%.

With the anticipated "Golden September" peak season, how are the sales and market share of several major heavy-duty truck companies? Which one stands out the most? Follow us to find out!

September saw 105,000 heavy-duty truck sales, with electric heavy-duty trucks setting a record.

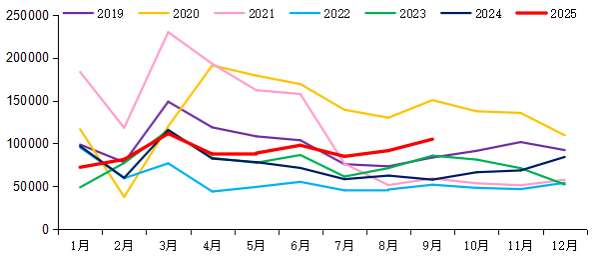

In September 2025, my country's heavy-duty truck market saw a total of approximately 105,000 units sold (wholesale basis, including exports and new energy vehicles), a 15% month-on-month increase and a significant 82% increase from the 58,000 units sold in the same period last year. To date, the heavy-duty truck market has achieved six consecutive months of growth, with an average growth rate of 39% over the past six months.

Over the past eight years, 105,000 units is only lower than the 151,000 units sold in September 2020, and higher than September sales in other years. The overall market performance exceeded expectations. Cumulative sales in my country's heavy-duty truck market exceeded 800,000 units from January to September this year, reaching approximately 821,000 units, a year-on-year increase of approximately 20%.

The significant year-on-year sales surge during the "Golden September" period was driven by a low sales base compared to the same period last year; the arrival of the road freight peak season, which boosted demand; and the promotion of the trade-in policy for National III and National IV operating trucks. Meanwhile, my country's heavy-duty truck exports have maintained steady growth since the second half of the year. Wholesale heavy-duty truck export sales in China are expected to increase by approximately 6% year-on-year in September, highlighting the strong competitiveness of "Made in China" products in the global automotive industry.

On the other hand, overseas exports continued to grow steadily. In August, wholesale heavy-duty truck export sales in China were expected to increase by approximately 10% year-on-year, with this segment also performing better than expected.

The continued year-on-year acceleration in heavy-duty truck wholesale sales is supported by strong domestic terminal sales. In September of this year, domestic terminal sales showed rapid year-on-year growth, reaching approximately 96% and increasing by approximately 27% month-on-month. The highly sought-after segments of gas trucks (natural gas heavy-duty trucks) and electric trucks (new energy heavy-duty trucks) also saw year-on-year increases.

Since the beginning of this year, new energy heavy-duty trucks have continued to sell well in the short- and medium-haul freight market. Coupled with the demand for replacing old trucks with electric trucks driven by the truck trade-in policy, terminal sales of new energy heavy-duty trucks are expected to exceed 22,000 units in September, a 1.85-fold year-on-year increase and approximately 27% month-on-month growth, setting a new monthly sales record for this segment. The industry penetration rate for the month is approximately 26%-27%. Furthermore, domestic diesel heavy-duty truck terminal sales are expected to increase by nearly 60% year-on-year in September, also contributing significantly to the growth.

Sinotruk retains top spot with 27,000 units, Jiefang sees tripled sales

In September's qualifying round, Sinotruk retained its top spot with 27,000 units, while Jiefang surpassed 21,000 units, a 200% year-on-year increase. Dongfeng, Foton, and XCMG all saw year-on-year sales growth exceeding 100%. Companies that outperformed the broader market included Jiefang (200%), Foton (137%), XCMG (133%), and Dongfeng (116%). Cumulatively, Foton and XCMG primarily achieved year-on-year increases in market share in the first three quarters of this year.

Specifically, Sinotruk sold approximately 27,000 heavy-duty trucks in September, a year-on-year increase of approximately 63%, maintaining its industry-leading sales position. Its cumulative sales from January to September totaled approximately 224,100 units, a year-on-year increase of approximately 19%, resulting in a market share of approximately 27.3%.

FAW Jiefang sold approximately 21,000 heavy-duty trucks in September, a year-on-year increase of approximately 200%, the highest growth rate among all major companies. From January to September 2025, Jiefang's cumulative heavy-duty truck sales reached approximately 153,000 units, a year-on-year increase of 12%, with a market share of approximately 18.6%, maintaining its second place in the industry.

Dongfeng Motor Corporation (including Dongfeng Commercial Vehicle and Dongfeng Liuzhou Chenglong) sold approximately 16,500 heavy-duty trucks in September, a year-on-year increase of approximately 116%, maintaining its position in the top three in monthly sales. From January to September this year, Dongfeng Motor sold a total of 131,500 heavy-duty trucks of all types, a year-on-year increase of approximately 21%, with a market share of approximately 16%.

Shaanxi Automobile Group (including Shaanxi Automobile Heavy Duty Truck and Shaanxi Automobile Commercial Vehicle) sold approximately 16,000 heavy-duty trucks in September, a year-on-year increase of approximately 44%. From January to September 2025, Shaanxi Automobile Group sold approximately 132,300 heavy-duty trucks of all types, a year-on-year increase of approximately 16%, with a market share of approximately 16.1%.

Beiqi Foton sold approximately 13,500 heavy-duty trucks in September, a year-on-year increase of approximately 137%, the second-highest year-on-year growth rate among mainstream companies (second only to Jiefang). From January to September 2025, Beiqi Foton sold a total of approximately 104,000 heavy-duty trucks of all types, a year-on-year increase of approximately 95%, with a market share of approximately 12.7%, an increase of approximately 4.9 percentage points year-on-year.

From January to September 2025, cumulative sales in my country's heavy-duty truck market exceeded 820,000 units. If the industry's average monthly sales reach 60,000 units in the next three months, annual heavy-duty truck sales will easily exceed 1 million units. If the industry's average monthly sales reach 93,000 units in the fourth quarter, annual heavy-duty truck sales will reach 1.1 million units.